Should I RENT or BUY?

I get asked this question a lot: It’s 2023, and the fabulously low interest rates have gone away. So, what should I do now? Last year I could afford more house, because interest rates were lower. But I got outbid every time! So Now I am still renting and wondering if I should still try to buy?

Well, here in Central Ohio we are in one of the top markets in the United States – our prices are not dropping like we hear about happening in other parts of the country. We continue to grow as we become the new midwestern tech market. So, prices are not going down for us in the foreseeable future. Estimates show we will gain close to a million more people in the next ten years in Central Ohio, so there are not enough homes for that expected growth. This lack of supply will keep our prices going up.

As we grow, housing will become more and more scarce. So prices will never be this low again.

Interest rates are higher than they were, but still a lot lower than the average over time—I paid 11% when buying my first home and was thrilled to get such a low rate. As rates went down, I refinanced that home several times, each time lowering the required payment allowing the cost of refinancing to more than pay for itself. So, rates are just relative to timing. That new lower payment also put me in a boat where I was used to the higher payment, so I just kept paying the old amount, and paid my home off faster that way.

Also here in Central Ohio, there is grant money available for first time buyers to take advantage of as they purchase their first home. Ask your lender more about this option for you—there are income requirements and a class to take.

On the flip side, rent is always 100% interest! So, when you move out of a rental, you don’t get any of that money back like you do when you own your home. And rent keeps going up year after year. House payments stay the same or may go down once you refinance or hit a certain level of equity. If you plan to live in the same place for at least two to three years, you will make enough increased equity to far outpace the rental market.

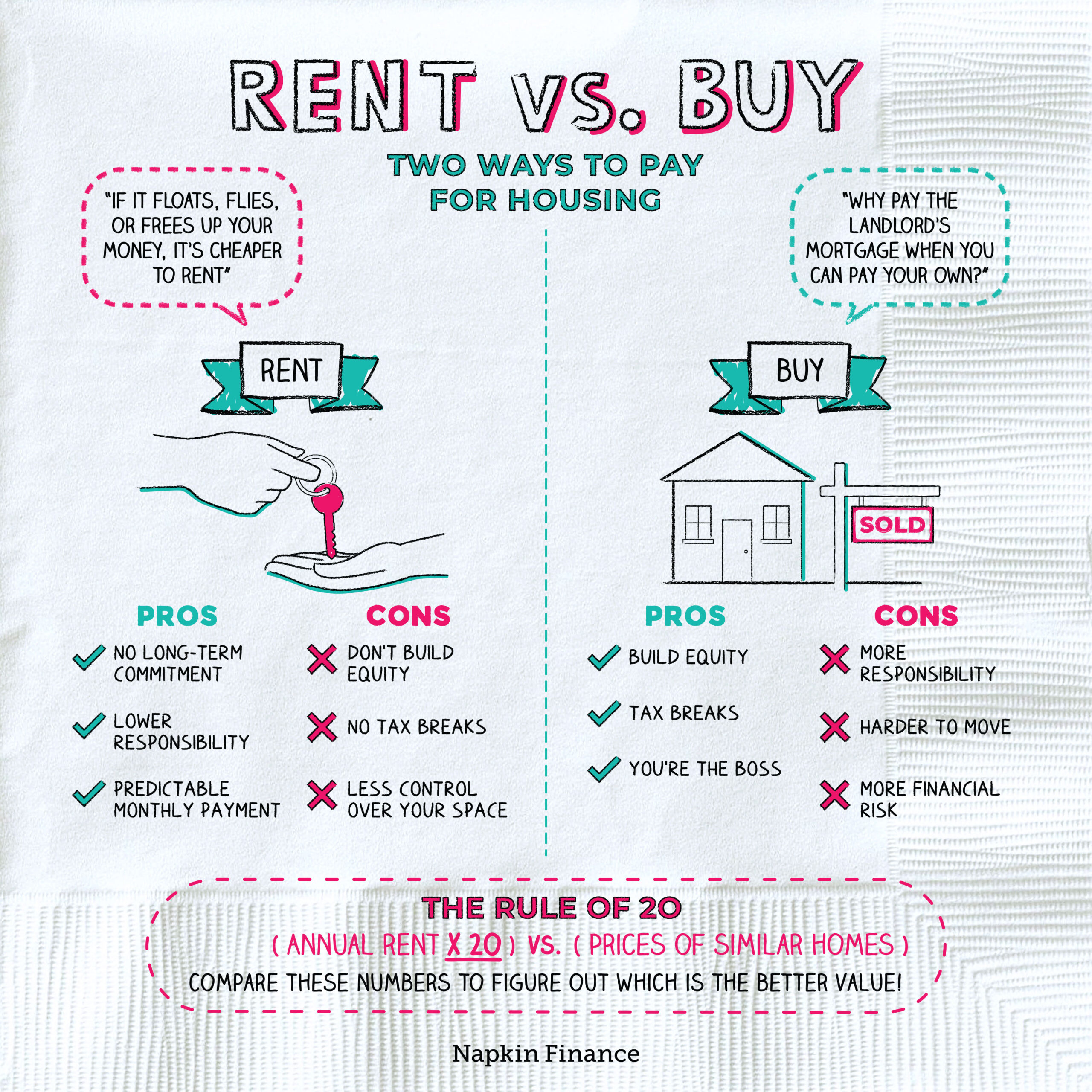

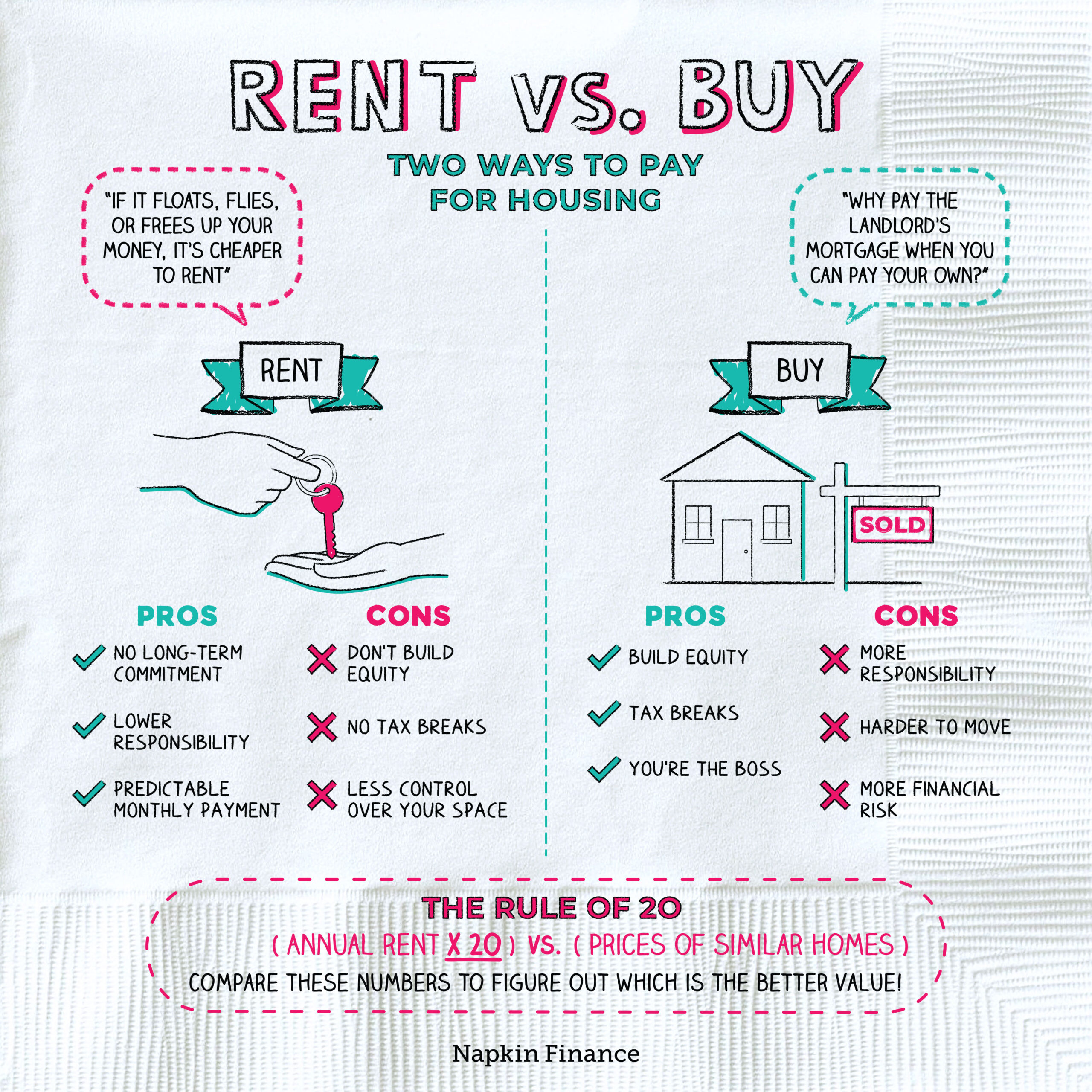

So most of the time, the right answer is to BUY. I found this great graphic from Napkin Finance that helps break it down:

Uncategorized •

April 11, 2023

Should I RENT or BUY?

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link